A child tax credit (CTC) is a scheme of government to support poor families that have dependent children. The families that make less than a certain amount per year may benefit from a child tax credit.

President Joe Biden has expanded the said policy this year as part of his American Rescue Plan Act (ARP). Earlier, the families were allowed to offset the child tax credit of $2,000 per child up to age 17. However, in the year 2021, the families are allowed to offset $3,000 per child up to age 18 and $3,600 per child under age 6.

The plan made the credit wholly refundable, and the families will have the option to receive half of the child tax credit in six months’ installments. The scheme has covered almost 39 million households and 88 % of the children in the U.S. However, the expansion of the policy is valid for this year only.

The scheme has immensely benefited in removing the child’s poverty. A study published by Urban Institute shows has shown that if the government expands the scheme in the next year as well, it will highly reduce child poverty in most parts of the U.S. In 2016, the child tax credit had successfully reduced the poverty of 3 million children.

According to a publication of Columbia University, the expansion of the policy to the next year will reduce child poverty by 26 %.

Kyle Rittenhouse Acquitted on All Charges

The talks are going on among the democrats about extending the child tax credit. Biden and Democrats in Congress are trying their best to uplift the boost in the policy.

If the Build Back Better Act passes in the parliament, it will extend the Child Tax Credit boost till the end of December 2022, but with few changes.

Let’s consider the changes proposed in the Build Back Better Act and their impact on the Tax Payer.

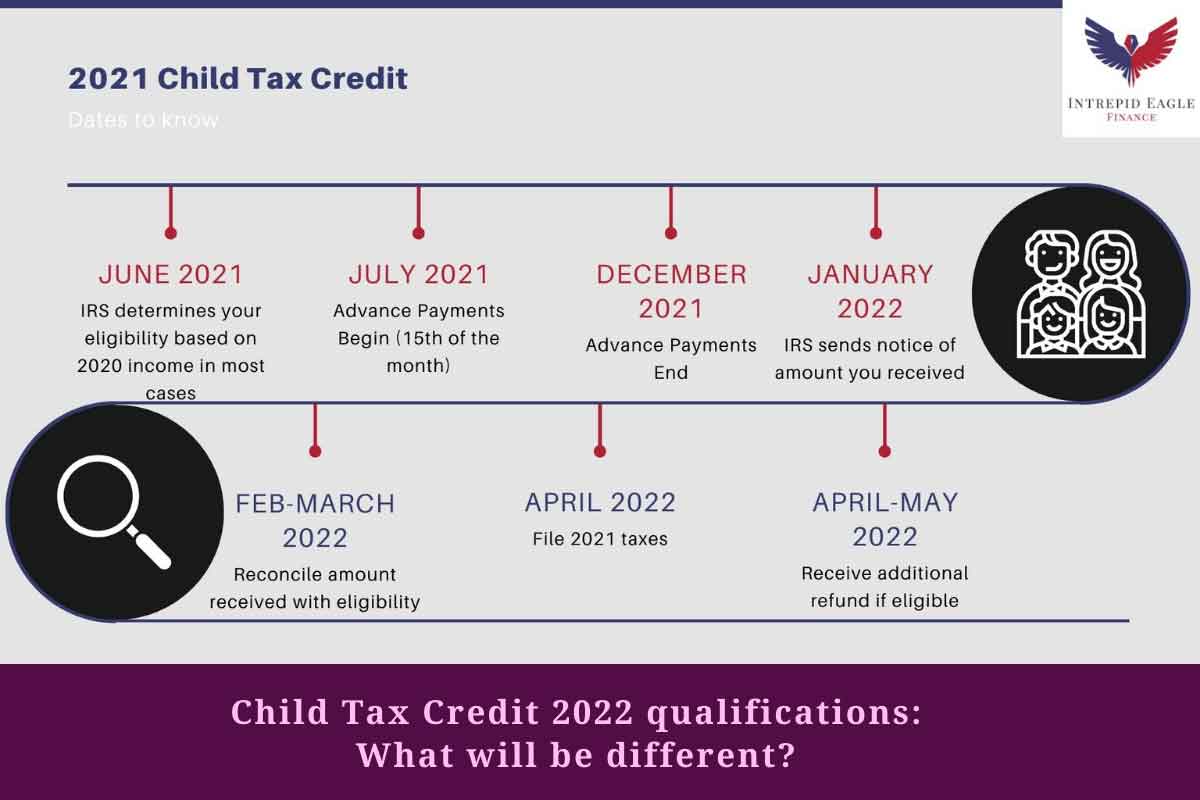

To understand the changes which will happen in 2022, let’s first understand the changes made in 2021.

Changes Made to Child Tax Credit in 2021

From 2018 till 2020, an offset was worth $2,000 per child for children aged up to 16 years or younger under the child credit tax.

However, in 2021, the offset became $3,000 for children aged 6 to 17 years old and $3,600 for children aged five or younger.

Potential Changes to Child Tax Credit in 2021

- More monthly payments

The first significant change in the Child Tax Credit in 2022 is the increase in monthly payments. In 2021, the recipient was eligible for half of the amount in six monthly installments starting from July to December. Later, the recipient will get another half in 2022.

Star’s Death: Natalie Wood’s Sister Says She Doesn’t Expect ‘a Deathbed Confession’ From Robert Wagner

Whereas, in the proposal for 2022, the recipient will get the full refund in 12 installments, starting from January to December.

- Decrease in number of people eligible for monthly payments

Earlier, single filers who make up $200,000 and married couples who jointly make up to $400,000 were eligible for the scheme. But, in 2020, the government modified the income limit.

If the bill pass, adjusted gross income (AGI) shall be $75,000 for single filers, $112,500 for head-of-household filers and $150,000 for joint filers will be eligible for the said scheme.

- No necessity for a Social Security number

Earlier, the child who did not social security number was not eligible for the child tax credit. When a person filed a tax return, it was essential to file his child’s social security number to get the advantage of the scheme.

The system of social security numbers became effective in 2018. However, no social security number of a child is necessary under the current proposal for 2022. This amendment will help non-citizens to get the benefit of a child credit scheme.

- Permanent refundability

There was a partial refundability in child Tax Credit till 2020. The recipient was only getting an amount of $1,400 per child. Further to get the benefit, the taxable person should have at least $2,500 as earned income.

Stimulus Check Updates Stimulus Check Updates: Latest on Child Tax Credit Payments, Cola 2022, IRS Tax Refunds…

However, the government quashed the limit of earned income in 2021. It also made the Child tax credit entirely and fully refundable. The current proposal under consideration will make the Child Tax Credit fully refundable permanently. However, it has one condition attached to it.

The qualifying person must be a resident of Puerto Rico or have lived in America for more than six months.

Lawmakers suggested that the said changes may be applicable only for 2022 to cut the cost and pressure upon the economy. However, others are pressing that the applicability of the expansion till 2025.