Bargain Hunters were once looking for one chance to pounce on skids in the shares of Facebook parent Meta Platforms Inc. However, that is not happening anymore.

The giant of Social Media witnessed its worst of all weeks since June of 2020. Investors have now fled riskier assets after the tilt by the Federal Revenue.

The Current Circumstances: The Decline

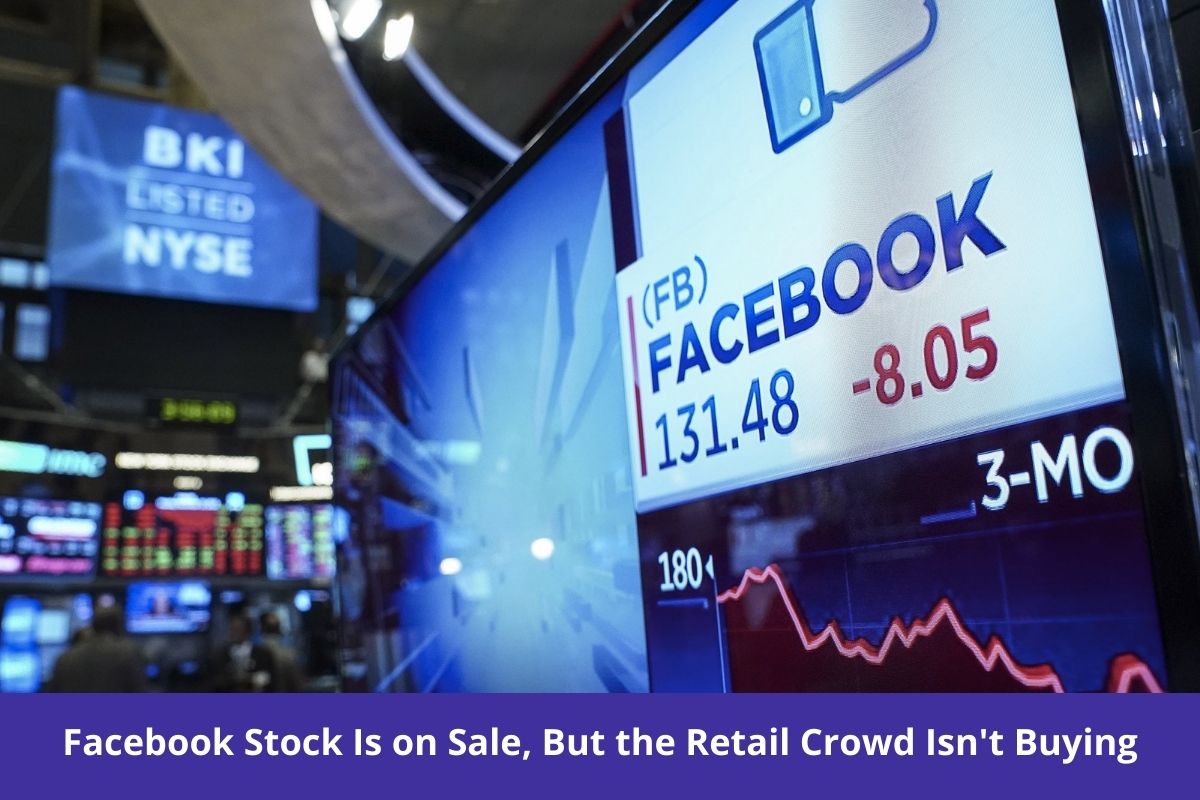

The decline of 7.9% of Meta over the last five sessions surpassed the decline of all the mega-cap technology peers. But, the retail investors that previously helped to lift the Stock out of the selloffs are no longer interested in buying.

According to data from Vanda Research, there has not been much of a change in the net purchases of Meta by the retail buyers; it is still around $40 million.

Mississippi Governor Says He Will Enforce a Law Banning Most Abortions in the State if Roe Is Overturned

A similar drop in the stock price was observed five weeks ago that prompted an inflow of more than $150 million, triggering a rebound in the shares. Currently, the cost of mega-cap stocks keeps dropping, the cheapest becoming even cheaper.

The stock is trading at a rate of 22 times earnings, lower than what it was in September (28 times earnings). That was a record high of Meta Shares; however, then they had to face the whistleblower situation, the release of internal data fueling intense scrutiny and more fear of regulatory risks.

Chief Executive Officer of Ladenburg Thalmann Asset Management Was Surprised

This weakness in the shares f Meta Platforms Inc. is quite surprising for the CEO of Ladenburg Thalmann Asset Management, Phil Blancato. Due to the pressures of stimulus measures by the Fed, he anticipates many high techs’ flyer will experience that strain; however, Meta is starting to look “attractive,” according to him.

He said there are indeed political pressures and breakup talk but, all look non-economic; from a valuation point of view, comparing their trading and earnings, it seems like an excellent opportunity.

The Data by Analysts

The sales of California-based company; The Menlo Park are projected to expand by 19% in 2022, faster the competitors like Alphabet Inc., Apple Inc., Amazon.com Inc., and Microsoft Corp., an average estimated by the analysts at Bloomberg.

This might be the reason why Wall Street is hopeful about the Stock. Meta Platform Inc. has a much higher percentage of buy ratings than Apple. Apple has outshined and outperformed Meta since the very start of the year. Based on the average price target, Meta has the highest return potential (at 31%) compared to the mega-cap peers.

Volcano Erupts in Indonesia: at Least 13 People Killed

Meta has been through many crises recently, and it constantly brings updates and innovations to all the apps it powers. The biggest of all changes recently brought about was changing the name to Meta and the introduction of the associated ideology of the moment in the time. Retail buyers might not be interested at the moment.

Still, nevertheless, Facebook and associated social media platforms have become the need of the youth literally, so Meta is a fantastic investment deal and has the highest return potential. Therefore, it will be amusing to see what happens in the stock market about this giant of social media.