Germany is the economic leader of Europe and one of the leading countries in the ranking of venture capital infrastructures. Launching a startup in Germany is a great idea, but it is a long process that requires effort, knowledge, and finances. Proper mentoring and team motivation directly affect the success of a startup and the direction of its development.

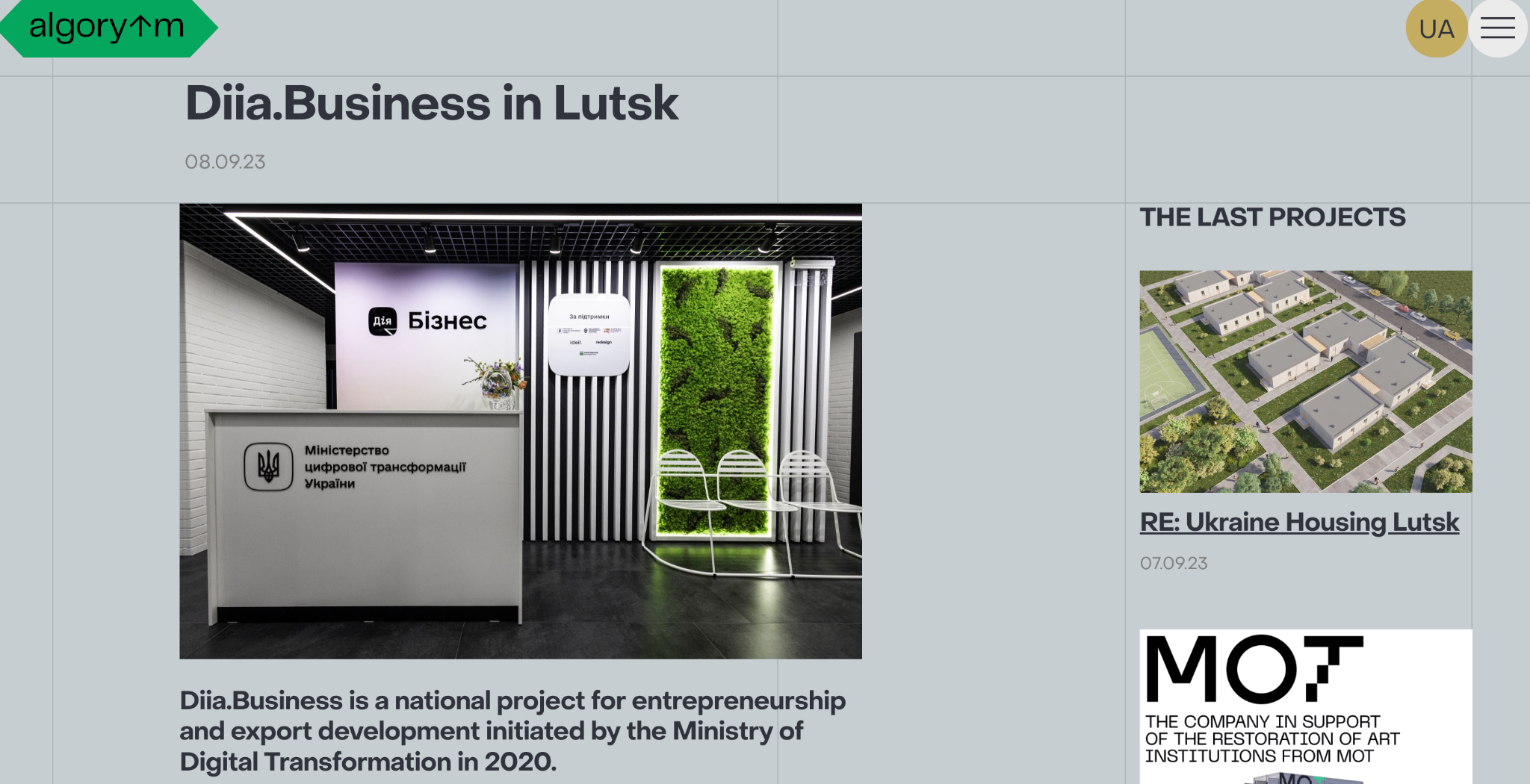

In this article, you will learn how to get support when launching a startup in Germany. You can also evaluate the approach of the Ukrainian center – Diia.Business in Lutsk, a national project to support entrepreneurship.

The Role of Accelerators And Venture Funds In The Development of Startups

Accelerator programs typically offer startup training from experienced entrepreneurs, industry experts, and investors. This may include seminars, master classes, lectures, and one-on-one mentoring.

Accelerators Available in Germany

1. Allianz Digital Accelerator, Munich

Direction: insurance, mobility, fintech, Internet of things

One of the most successful accelerators in its industry. Every year, in the spring, the program selects the best startup companies that have demonstrated uniqueness and an unusual approach to their projects. Training is free for 8 months.

2. Axel Springer Plug & Play, Berlin

Direction: media, E-Health, fintech

The program selects the most interesting projects that receive support throughout the year. Startups can count on full assistance in implementing their projects and developing the structure of new products. Such training costs 10,000 euros.

3. DB Accelerator Mindbox, Berlin

Direction: all areas related to railway transport

The accelerator has government support for the development of transport systems. The training takes place over 6 months. The cost of such support is estimated at 4,000 euros.

4. Merck Accelerator, Darmstadt

Directions: healthcare, high-level innovative solutions for the field of Performance Materials

Another accelerator with full government support for implementing unique projects from the best startups in the country. Training has several stages. The full process takes up to one calendar year. The state finances the training if the startup project has potential in its industry.

5. TechFounders, Garching (Bavaria)

The accelerator is open to all industries. Partners include BMW, Bosch, and Siemens.

Considering large partners and enormous financial support, this accelerator is one of the most desirable for startups related to the technology industry. The training takes place over 5 months. The cost of the course varies from 5,000 to 20,000 euros.

Venture Funds Available in Germany

Venture funds often provide not only financial support, but also actively accompany the development of a startup, helping it scale, attract new employees, and resolve strategic issues.

1. Omnes Capital

The fund is a renowned player in the private equity space, with strong experience in venture capital and co-investment. Since 2005, Omnes Capital has invested more than 400 million euros and holds minority stakes in unique businesses with great potential in industries such as IT and natural sciences. Omnes Capital invests in companies at various stages, including Series A, and B rounds, and spin-offs.

2. Earlybird

This fund, which started in 1997, supports technology companies at various stages of development. In addition to financing, it offers projects operational and strategic support. It is one of Europe’s most popular funds, with seven IPOs and over $1 billion under management.

3. Maxfield Capital

The fund specializes in seed and early investments in companies that are ready to explore global markets. The priority for the fund is technologies that help reduce the gap between people and machines. Thus, the main areas of investment are mobile platforms, processing of large data sets, fin-tech, e-health, etc.

4.IDInvest Partners

The main goal of this fund is financial support for European businesses at various stages of growth. The fund has approximately €8 billion under management. IDInvest Partners’ investment account has more than 4,000 European companies involved in various industries. One such area is direct equity investment in young, innovative companies with high growth potential.

5. Holtzbrinck Ventures

Holtzbrinck Ventures is a leading German venture capital firm based in Munich. They invest all over the world. Today they have over €1 billion under management, making them one of the largest and most experienced independent European early-stage venture capital funds.

6. Seedcamp

Seedcamp is an early-stage venture capital fund that invests in world-class startups targeting major global markets and solving real-world problems using technology. They support world-class entrepreneurs before their success is known to others. Seedcamp is considered one of Germany and Europe’s largest venture capital funds. Its capital is estimated at more than $1 billion.

7. Amadeus Capital Partners

This is a global investor with a technology focus. Since 1997, the fund has supported more than 130 companies and raised more than $1 billion in investment. The fund’s team has extensive experience in investing and a limitless network of partners who focus on projects where the main point is in technologies that change reality. The fund primarily invests in consumer services, financial technology, AI, cybersecurity, health technology, digital health, and digital media.

Conclusion

Every startup needs support at the start, as this is the key to sustainable business development and eliminating various types of risks. Often such support can be obtained through projects organized by the authorities for the development of entrepreneurship and through accelerators. If you are interested in entrepreneurship in Ukraine, you can consult with the Diia.Business center, which is available both in Ukraine and abroad. There is one such center in Lutsk; you can learn more about its work on the NGO Algorithm of Actions platform.