As per the plan, in April 2021, the President of the United States of America, Joe Biden from the last Covid relief bill distributed a third-round renewal check. They were reported to have a hefty amount of USD 1400.

The IRS processed around 4,000,000 payments, and most of them successfully received their check. But there were some unfortunate ones too, who didn’t get theirs. If you are one of them, don’t worry, there is still a way to track them from the IRS.

What Is the IRS?

IRS stands for International Revenue Service. It is an American federal agency which deals with tax collection and laws related to taxation. President Abraham Lincoln was established in 1862 to handle the affairs of tax collection and related issues.

How to Track Your 1,400 Us Dollars Renewal Check From the IRS?

There is a cool app named Get My Payment tools to check that the IRS website has been uploading your third-party payment data to a device on its website called Get My Payment.

You will be able to see the date you would expect to receive your renewal payment or the date it was posted or sent once your information has been updated. You should also be able to see if your money was deposited directly or whether you will receive payment by post.

Many people see the message that the IRS may not have enough information yet or may not be eligible to pay. This message does not necessarily mean you are not eligible to pay. This information may be updated this coming weekend.

Employee Walkout at Boston Market Leaves Customers Without Pre-ordered Thanksgiving Meals: Report

Here are some of the problems people see with their actual deposit or the Get My Payment tool.

-

Have You Received a Message “Payment Status Not Available”?

Many who were looking at their second refresh check saw the message “Payment Status # 2 – Not Available.” The IRS has indicated that these individuals will not receive a renewal check by direct deposit or e-mail and will need to complete their 2020 tax return.

-

How to Apply for a Discounted Discount Credit?

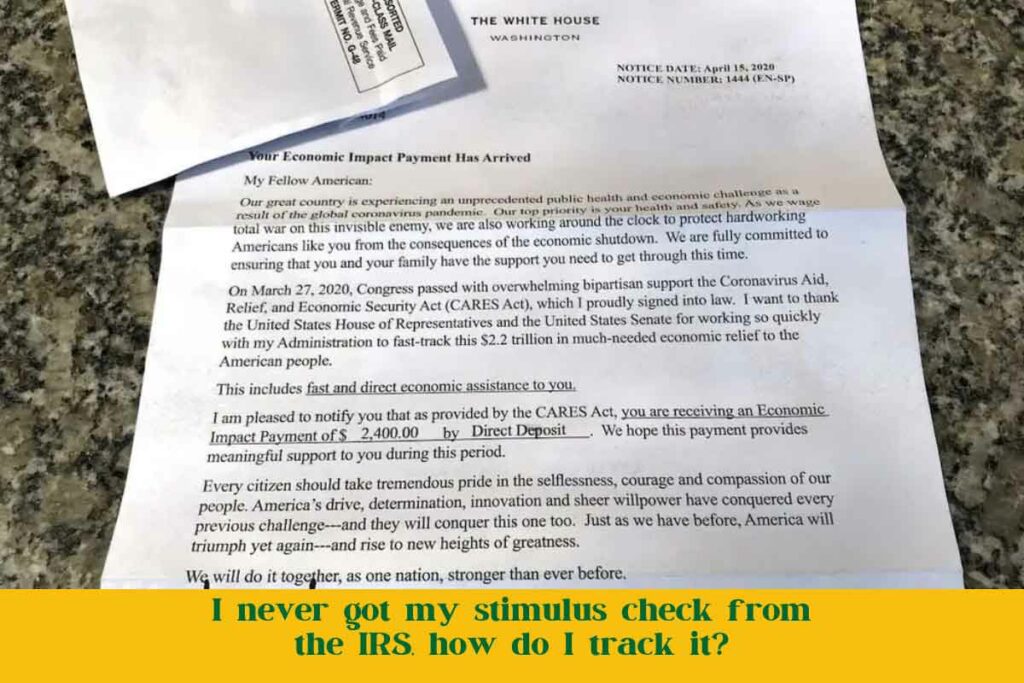

If you’re someone who did not receive 1st or 2nd renewal payment or the amount was an invalid one. You will be required to submit a tax return for the year 2020. You will be required to submit Form 1040 (if you’re a minor) or Form 1040-SR (if you’re an adult). By now you must have Notice 1444 and Notice 1444-b. You will need the payment amount in the letter when you submit your tax returns by 2021.

-

What to Do if the Irs Needs More Information?

If the tool gives you a payment date, but you still have not received your money, the IRS may need additional information. Check the Receive My Payment tool again, and if it reports “Need More Information,” this might be the indication that your check has been returned because the post was unable to deliver it to you, an IRS representative told CNET. Here are some details on how the tracker tool works and what the messages mean.

-

Tracking Payment to Get Lost Renewal Money

You can request an IRS payment tracking if you receive a letter confirming from the IRS that your payment has been sent (also known as Notice 1444), or if the Receive My Payment tool will provide the indication that your payment has been withdrawn, but you have not received it within a specified period. Frames. This is true for all three checks. See our guide to requesting an IRS Payment Trace here.

Bryan Adams Announces Second Covid-19 Diagnosis in a Month