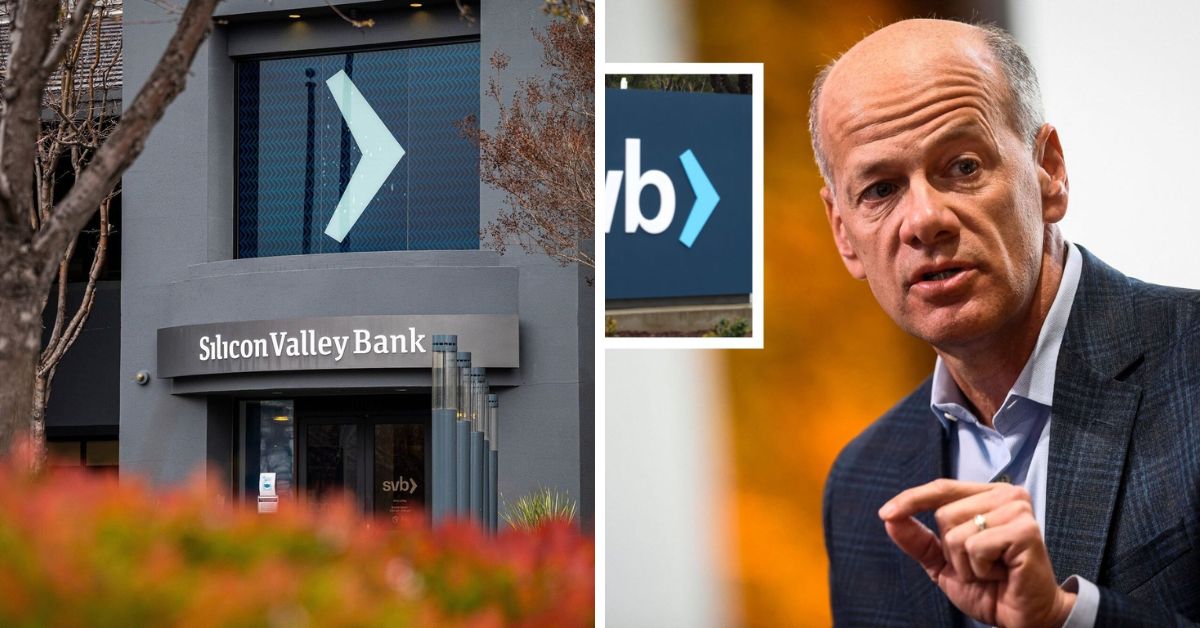

This week, the US bank that was the go-to for tech startups quickly fell apart, leaving its high-powered customers and investors in the dark. Due to a sudden bank run and a lack of money, Silicon Valley Bank failed on Friday morning and was taken over by the government.

It was the biggest US bank failure since 2008, when Washington Mutual went bankrupt. Here is what we know about what happened to the bank and what could happen next.

What Does SVB Stand for?

Since its founding in 1983, SVB has focused on being a bank for tech startups. It gave money to almost half of the technology and health care companies in the US that were backed by venture capital.

Even though most people don’t know about SVB outside of Silicon Valley, the FDIC says that it was one of the top 20 American commercial banks at the end of last year, with total assets of $209 billion.

Check out some other new content we’ve published:

- Texas Women Face Wrongful Death Lawsuit Over Abortion Assistance

- Seattle Area Couple’s Tragic Murder Highlights the Dangers of Online Stalking

Why Did It Fail?

In short, there was a classic “run on the bank” at SVB. The longer version is a little bit harder to understand. Several things came together to bring the banker down.

First, there was the Federal Reserve, which started raising interest rates a year ago to stop inflation. The Fed moved quickly, and when borrowing costs went up, tech stocks lost their momentum, which hurt SVB.

Higher interest rates also made long-term bonds that SVB and other banks bought when interest rates were very low or close to zero less valuable. The average return on SVB’s $21 billion bond portfolio was 1.79%, while the current yield on a 10-year Treasury is about 3.9%.

At the same time, venture capital started to dry up. This meant that startups had to take money from SVB. So, the bank was sitting on a huge pile of unrealized losses in bonds at the same time that customers were taking out more money.

How Contagion Fears Subside?

On Wednesday, SVB said it had sold a bunch of securities at a loss and would also sell $2.25 billion worth of new shares to fix its balance sheet. Key venture capital firms got scared, and they reportedly told companies to take their money out of the bank.

The bank’s stock started going down Thursday morning, and by the afternoon, it was dragging down other bank stocks with it as investors worried about a repeat of the financial crisis of 2007-2008.

By Friday morning, trading in SVB shares had been stopped, and the company had given up on trying to quickly raise money or sell itself. California regulators stepped in, shut down the bank, and put it under the care of the Federal Deposit Insurance Corporation as a receivership.

Moving Beyond the Fear of an Outbreak

Analysts said that even though there was panic on Wall Street at first, SVB’s bankruptcy is not likely to cause the same domino effect that shook the banking industry during the financial crisis.

Moody’s chief economist Mark Zandi said, “The system is as well-capitalized and liquid as it has ever been.” “The banks that are in trouble right now aren’t big enough to pose a real threat to the system as a whole.”

The FDIC says that all people who have insured deposits will have full access to them by Monday morning at the latest. It will give depositors who are not covered by insurance a “advance dividend” in the next week.

What Comes Next?

So, while a wider spread of the problem is unlikely, Ed Moya, a senior market analyst at Oanda, says that smaller banks with a lot of ties to cash-strapped industries like tech and crypto may be in for a rough ride.

“Everyone on Wall Street knew that the Fed’s plan to raise interest rates would break something in the end,” Moya said on Friday. “Right now, that something is small banks,” he added.

Most of the time, the FDIC sells the assets of a failed bank to other banks and uses the money to pay back depositors whose money wasn’t insured. SVB could still find a buyer, but this is not a sure thing.

SVB latest post:

https://twitter.com/SVB_Financial/status/1633113774260379653

Follow Us on Twitter for the Latest News and Updates