You’re not the only one who needs to borrow money to pay for education. 54% of bachelor’s degree recipients from public and private nonprofit colleges, according to the College Board, graduate with debt from student loans.

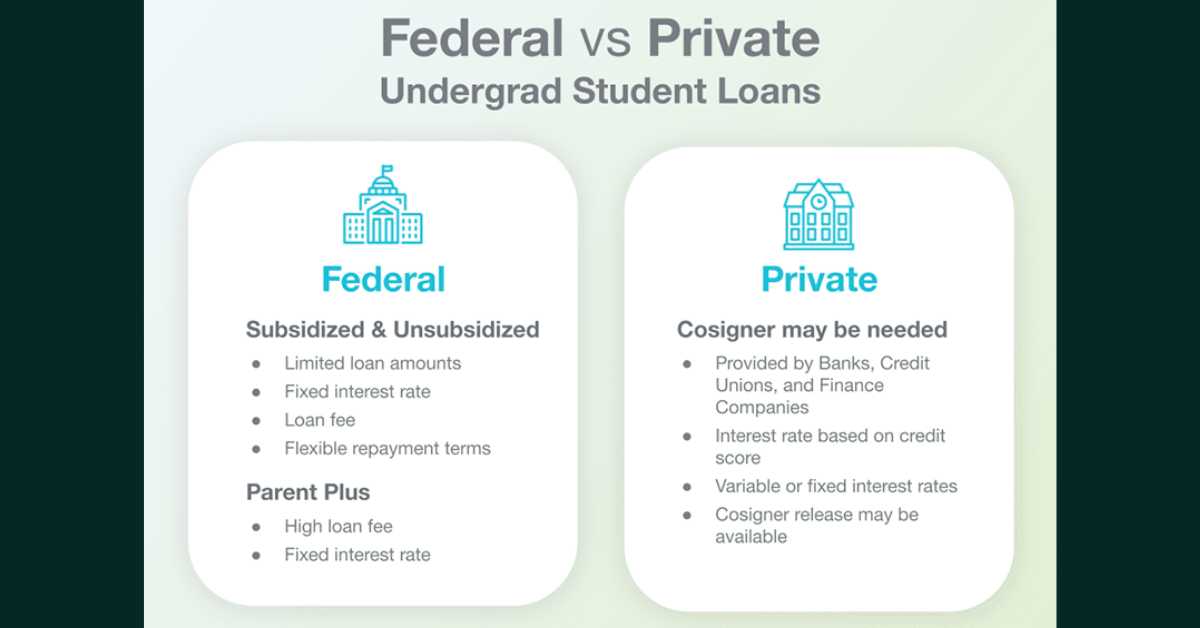

Federal loans and private loans are the two primary categories of student loans. Your repayment options and overall cost may change depending on the sort of student loan you take out.

Which is better, federal or private loans? That depends on your program, your financial situation, and whether you qualify for financial aid.

What Are Federal Student Loans?

The U.S. Department of Education serves as the lender for federal student loans, a particular category of student loans. They account for a hefty portion of all active loans. In actuality, 92.78% of the $1.76 trillion in national student loan debt is made up of federal loans.

Financial experts and groups emphasized using up all federal financial aid, including federal student loans, before turning to private loans, including the National Association of Financial Aid Administrators, the Consumer Financial Protection Bureau, and The Institute for College Access & Success. Why? The government offers more borrower safeguards and repayment choices than private lenders, and they typically have cheaper rates than private loans.

There are four types of student loans offered by the federal government to students and their parents:

- Direct Subsidized: These loans are exclusively available to undergraduate students. Students must have substantial financial needs. The government waives interest that accumulates while the student is enrolled in school, throughout the loan grace period, and during any periods of deferment.

- Direct Unsubsidized: Direct Unsubsidized loans can be utilized for undergraduate or graduate studies; graduate school loans will have higher interest rates. All accrued interest is the student’s responsibility.

- Grad PLUS: Graduate and professional students can borrow up to the whole cost of attendance for their degree using Grad PLUS Loans.

- Parent PLUS: Parents can borrow money to cover the costs of their biological or adopted child’s undergraduate education.

All government loans have set interest rates, and all borrowers, regardless of credit or income, are eligible for the same rate. All federal student loans have a 10-year repayment term by default.

What is a Private Student Loan?

Just 7% of the whole student loan market is made up of private loans. Private student loans can be obtained from banks, credit unions, and other financial entities, as opposed to the federal government, which issues federal loans.

Federal loans have fixed interest rates, but private student loans may have variable or fixed rates. Although the rates on variable-rate loans can alter over time, they often have lower introductory rates than fixed-rate loans. Furthermore, repayment lengths can be from five to fifteen years.

Undergraduate or graduate degrees can be paid for with private student loans. Private loans, on the other hand, are credit-based, which means that lenders have rigorous criteria for borrowers, and not everyone will be eligible for a loan.

Private Loan Eligibility

Private lenders typically demand borrowers to have good to exceptional credit, which is defined as a FICO credit score of 670 or more, and fulfill specific income requirements, although conditions differ per lender.

Most college students will require a parent or other family member to co-sign the loan with them because they may not have strong credit (or any credit history at all) and are unlikely to have a reliable source of income. The relative accepts joint liability for the loan’s repayment by co-signing. The co-signer is responsible for making the payments in the primary borrower’s stead if they fall behind.

Six Main Differences Between Federal and Private Loans

Consider the following six key distinctions when deciding which forms of student loans to use:

1. Annual and Lifetime Borrowing Limits

Federal student loans have considerably different annual and lifetime borrowing restrictions than private student loans, with private loans having greater maximums.

The direct subsidized and direct unsubsidized student loan ceilings were set by the federal government. The annual ceiling ranges from $3,500 to $12,500 for undergraduate students and up to $20,500 for graduate students depending on your dependent status and the year you start college.

There is also a cumulative or lifetime maximum. For undergraduate students, it ranges from $31,000 to $57,500, and for graduate students, it is $138,500 (this figure includes all federal student loans you used for undergraduate education as well).

Private loan providers almost never have a set cap; instead, they let borrowers borrow up to the full cost of their program’s tuition. They are an advantageous choice for borrowers who have achieved the yearly or lifetime borrowing limits and require additional funds to pay for school because their lending maximums are less stringent than those of federal loans.

2. Income and Credit Requirements

Federal loans are often more accessible to those who qualify. Federal student loans do not have minimum income limits, and credit checks are not required for Direct Subsidized or Direct Unsubsidized loans.

Those who apply for federal PLUS Loans will have their credit checked, but it won’t be a thorough examination. The government examines your credit report to check if you have an adverse credit history, which refers to recent major credit concerns like foreclosure, auto repossession, or collections, rather than looking for a specific FICO score or better.

Private loans have stricter requirements. Typically, borrowers must have proven credit histories, FICO scores of 670 or above, and minimum income requirements. The only way to be approved for a loan if they don’t meet the lender’s requirements is to include a co-signer on their application.

3. Interest rates and type of interest

Undergraduate loans typically have low-interest rates that are fixed for all federal loans. When the loan is given to you, they also have disbursement costs taken out.

Private loans occasionally involve origination or disbursement fees and may have fixed or variable interest rates. Depending on the lender and whether the loan is for graduate or undergraduate studies, interest rates change. Rates for variable-rate loans ranged from 4.44% to 18.00% as of July 2023, while rates for fixed-rate loans ranged from 4.42% to 18.00%. No disbursement fees were assessed by any of the 10 lenders we reviewed.

Important: Grad and Parent PLUS Loans have the highest interest rate ever since the Direct Loan program was launched. Borrowers with excellent credit may qualify for private graduate or parent loans with lower rates, but keep in mind that private loans lack some of the benefits and protections of federal loans.

4. Plans for in-school payments

In comparison to private lenders, federal student loans are typically more forgiving when it comes to in-school repayment. While enrolled in classes or during their grace periods, which are the six months following graduation or leaving college, students are not required to make payments.

You could have to make payments on private student loans even though you’re still in school. Private lenders often offer a variety of choices for in-school repayment. You can have the option to select from the following plans, depending on the lender:

- Immediate: You begin making full principal and interest payments each month as soon as the loan is disbursed.

- Interest-only: You make monthly payments to cover the accrued interest while you’re in school after the loan is authorized. When you graduate, your payments increase, and you also contribute to the principal.

- Fixed: A fixed payment plan requires you to pay a set sum, such as $25 per month, while in college. When you graduate, your payments will increase to cover both the principal and interest.

- Deferred: If you choose deferred repayment, you will not be required to make any payments until after you graduate. The deferred payment option has the highest overall repayment cost since interest accumulates while you are in school.

5. Options for Repayment and Hardship After Graduation

Borrower safety is one area where federal student loans excel. Depending on your circumstances, you may be eligible for the following options:

- If you’re ill or unemployed: You may be qualified for a government deferment program if you get seriously ill or lose your work. You can postpone your payments for several months at a time with these methods.

- If you return to school: If you decide to return to school to acquire another degree, you can postpone your federal student loan payments until you graduate or leave school.

- If your payment is too high: If you can’t afford the monthly payments on a regular 10-year repayment plan, you might be able to qualify for an income-driven repayment (IDR) plan. Payments are calculated as a proportion of your disposable income, and some borrowers qualify for payments as little as $0.

6. Eligibility for Loan Forgiveness

Loan forgiveness options for federal student loans are common. As an example:

- Public Service Loan Forgiveness: Borrowers who meet the program’s qualifying conditions may be eligible for Public Service Loan Forgiveness (PSLF) and have up to 100% of their outstanding loans forgiven. They must work full-time for a qualifying non-profit organization or government agency for at least ten years and make 120 qualifying monthly payments.

- Teacher Loan Forgiveness: Teachers who have taught high-need courses in low-income schools or education service organizations for at least five years may be eligible for loan forgiveness of up to $17,500.

- Income-Driven Repayment Discharge: If you enroll in an IDR plan and have outstanding federal loans at the end of your loan term, the government will discharge the balance.

Private student loans are not eligible for federal loan forgiveness programs such as PSLF or TLF. However, they may be eligible for state debt payback programs or employer repayment aid based on their work.

We have recently covered top articles related to Student Loan Forgiveness. If you want to know more details you can check the links below:

- Who Gets Student Loan Forgiveness? Here Everything You Need to Know

- Student Loan Forgiveness: What’s getting fixed? Latest Update

Are Federal or Private Loans Better?

Most students should start with federal student loans, but private student loans can cover a gap if you exceed the yearly or aggregate borrowing restrictions or do not qualify for federal student loans. Taking out a private loan may enable you to complete your program and acquire the degree you would not be able to afford otherwise.

Exploring your financial aid options? You may be considering student loans, but keep in mind there’s a difference between federal and private loans. https://t.co/0rxC0XRj7m pic.twitter.com/Fe8VLBmTgq

— Federal Student Aid (@FAFSA) December 3, 2021