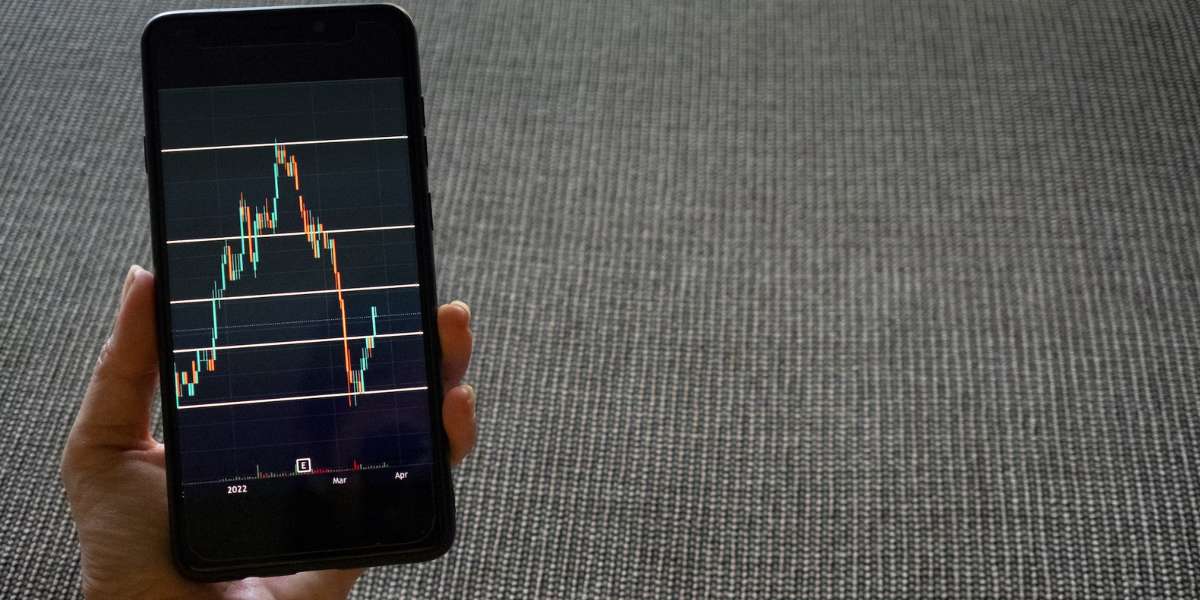

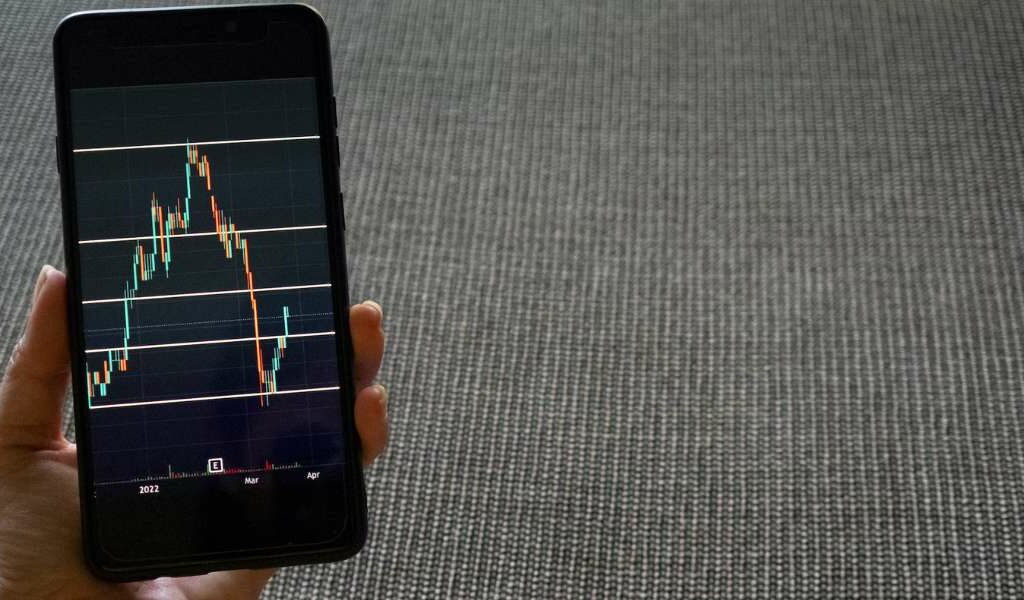

Understanding basic candlestick charts can be a valuable skill for both beginners and experienced traders, as they can help determine four price points – close, open, low, and high. From cryptocurrency to stocks, these analysis tools can be used to improve the trading strategy of a wide range of liquid assets. If you are going to invest in Bitcoin, a solid knowledge of candlestick patterns can help you gain a sense of whether the market is going bearish or bullish. The same applies to bonds, stocks, or other liquid assets.

Trading is a game of different technical analyses and statistical data, where tools like graphs, charts, and candlesticks can close knowledge gaps and help investors decide with more accuracy what their portfolio should include and when it’s time to make a trading move. Candlesticks are among the most widespread and popular elements of technical analysis, given how quickly and effectively they enable traders to analyze information regarding the price of an asset. They are generally utilized in technical analysis to determine a security’s price fluctuations. They are used mainly in day trading to predict patterns and make better and more informed trading decisions. Understanding several bars is enough, and as you’ll come to know by the end of this article, interpreting them takes a little bit of practice and expertise. Let’s understand the features and use cases of candlesticks to make more informed trading decisions.

Meaning of candlesticks

Candlestick charts, or candlesticks, represent types of visual aids in the form of price charts that help traders make better decisions in their options, commodities, foreign exchange, or stock trading. Usually, these analysis tools depict the price fluctuations of a derivative, security, currency, or cryptocurrency, but use cases can be extended to other financial instruments.

A candlestick chart is built from individuals’ candles and helps traders understand better where the value of an asset is going. As stated, they help examine the opening and closing prices of an asset posted for intraday trading regularly.

The idea is anything but new. In fact, it was born over four centuries ago when rice merchants in Japan used similar diagrams to calculate the price of their offerings.

Bar charts vs. candlesticks

Candlestick charts and bar charts disclose similar data, only in a different way. Bar charts place more emphasis on the closing price of a specific period instead of the opening price of that same given time. On the other hand, the candlestick chart considers the actual opening price for a particular period.

Interpreting the four points

Through the following informational elements, each candlestick symbolizes one day’s worth of price information about a stock.

Open. Just like the name suggests, the open point shows the opening price of an asset at the initial moment of trading.

High. Usually, candlesticks register value fluctuations over different period spans. In the given timeframe, the “upper shadow” of the chart shows the highest price set for the asset. Here, it’s important to remember that if the opening price were the highest on the chart, then the upper shadow wouldn’t exist.

Low. This limit opposes the upper price point, as the “lower shadow” represents the lowest price of a specific asset. Similarly, if the opening price when the market opens is the lowest, then there wouldn’t be a “lower shadow” depicted.

Close. The close point displays the last price traded since the candle’s creation. The candlestick turns red by default in most charts if the open point is above the close point. Consequently, it will become green or blue when the open price is below the close point, indicating growth.

Range. The range of price fluctuations for an asset can be deduced. Its range can be determined by separating the lowest from the highest bid in an intraday operation. Take into account that a stock’s price and volatility range are strongly associated.

Essential tips when trading with candlesticks

Navigate spending

Long-term investments are unquestionably superior to any other type of investment, as this strategy helps you overcome the inherent volatility that some assets are subjected to and weather bearish momentums. However, this doesn’t mean you should overspend your investment funds in haste, as this can rarely prove financially rewarding. Instead, choose a specific amount that you’re comfortable investing monthly and spread it across different assets.

You should never allocate all your money to one purchase or spend your entire budget at once. This recommendation is even more constructive when dealing with FOMO trading, fear trading, impulsive trading, or other behaviors that may lead to irresponsible decisions.

Exercise due diligence

Regardless of how trustworthy a trading tip may seem, there is no reason why you should follow it unthinkingly. The internet abounds with tricks and tips that are anything but helpful and reliable. Trading stocks and other assets are no child’s play and become increasingly riskier with the amount of money you invest in an asset. As such, no matter the source of information and whether you’re receiving advice from an experienced investor or a self-made guru in financial investments, you should stay within the golden rule of trading, namely conducting research and deciding on the next moves.

Sell bad-performing assets

Great stocks can fall abruptly and leave a hole in your pocket, and regardless of how well they’ve previously performed, there’s no guarantee that they’ll return to their glorious days. Being realistic about both the worst-case and best-case scenarios that could occur is crucial, with a focus on the former scenario. When you become aware of a stock’s underperformance, it is wise to accept that it is time to leave your portfolio or be exchanged for another asset and sell it as soon as possible to limit potential losses.

Last words

Technical traders have long used candlestick charts as they’re easily understandable and manageable, providing the information needed about a stock’s trajectory on point and succinctly. These help convey trader sentiments, price directions and fluctuations, helping intraday traders identify price patterns to determine whether it’s time to make a market exit or entry.