In a bid to slow the economy and rein in inflation, the Federal Reserve announced on Wednesday that it would boost its short-term borrowing rate by 0.25 percentage points.

The Fed has tried to stop prices from going up by slowing the economy and cutting off demand. It has done this by raising the cost of borrowing money several times. But this plan could send the U.S. economy into a recession and put millions of people out of work.

The Fed’s decision comes a few weeks after a government report showed that inflation slowed in December, making it six months in a row that prices have been going up less quickly.

Fed Chair Jerome Powell promised at a press conference on Wednesday that the fight against inflation would go on. Even though inflation has been going down in recent months, he said that it is still too high and that interest rates will need to stay high in order to bring inflation back to normal levels.

“Without price stability, the economy doesn’t work for anyone”

– Powell said.

“We will need substantially more evidence to be confident inflation is on a sustained downward path.”

“We will stay the course until the job is done.”

Do you know that China’s GDP grew by only 3% in 2022? This was one of the worst years in recent memory, as Beijing’s “zero-COVID” policy and weakening global demand hurt the second-largest economy in the world.

In a statement, the Federal Reserve said that it is still “very aware of inflation risks” and that the benchmark interest rate would need “ongoing increases” to bring inflation back to normal levels.

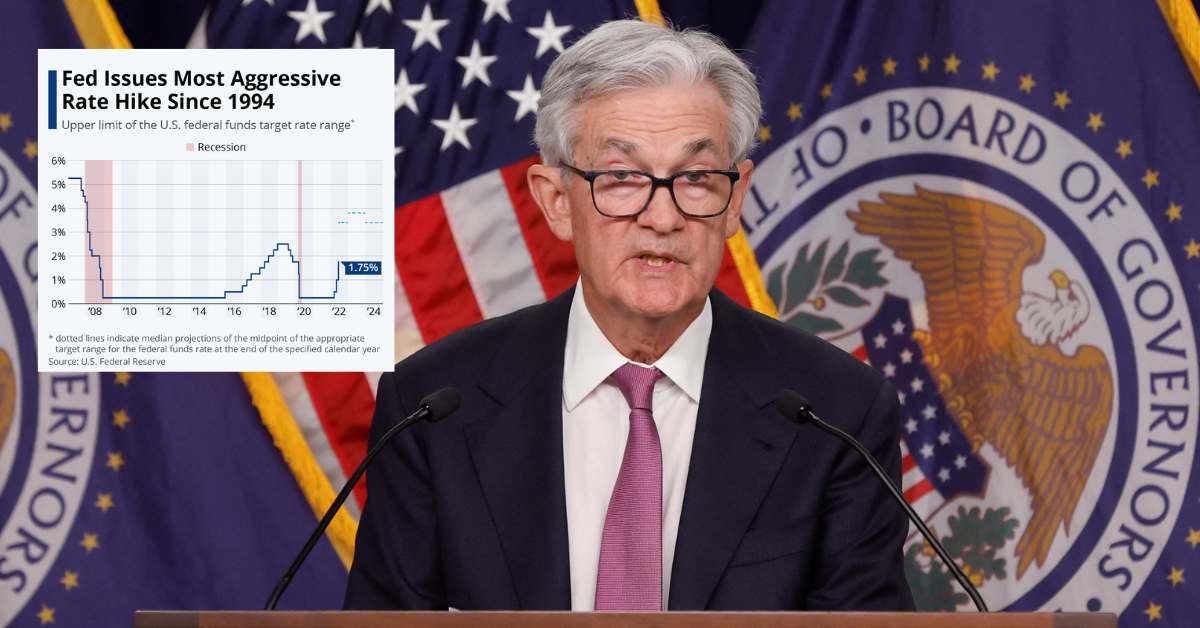

At a meeting in December, the Fed raised the short-term borrowing rate by half of a percentage point. This was after three consecutive increases of 0.75%, and it showed confidence that sky-high inflation could be brought down to normal levels.

With the 0.25% rate hike on Wednesday, the Fed did what economists expected. Consumer prices went up 6.5% in the year that ended in December. This is a big drop from the peak in the summer, but it is still more than three times the Fed’s target inflation rate of 2%.

The central bank said in a statement on Wednesday that the Fed is still “strongly committed to returning inflation to its 2% objective.” As inflation has gone down, people have become more hopeful that the U.S. economy might not go into a recession.

The International Monetary Fund said in a report on Monday that the U.S. economy would grow more slowly this year, but that the country could still avoid a recession.

Also, data released by the government last week showed that the U.S. economy grew strongly at the end of last year, despite fears that a recession was coming soon.

Still, a survey from Bloomberg that came out last week showed that most economists think the economy will go into a recession by the end of the year because of rising interest rates. The survey found that forecasters think the GDP will go down in the second and third quarters of this year.

There is more and more evidence that the Fed’s rate hikes have slowed down some economic activity. The National Association of Realtors says that home sales fell for the eleventh straight month in December, reaching their lowest rate since November 2010.

Also, retail sales in the U.S. went down in December, putting a quiet end to the usually busy holiday shopping season. Last month, retail sales fell by about 1% compared to the same time last year. This continued a drop that was almost the same in November.

So far, though, the job market has been strong, giving policymakers hope that they can lower prices without causing a lot of people to lose their jobs. Employers added 233,000 jobs in December, and wages went up by a strong 4.6% compared to a year ago.